Join us for Money Smart Week—a week of virtual financial literacy programming Saturday, April 15 through Friday, April 21, 2023. This week-long, free, virtual campaign aims to help people better manage their personal finances with a focus on tools for low and moderate income communities. Live events will include sessions on budgeting, debt relief, employer retirement plans, and a Spanish language session on financial institutions.

View more details at www.moneysmartweek.org. Events are free and open to the public, but registration is advised. Questions for the panelists can be submitted during the registration process.

View more details at www.moneysmartweek.org. Events are free and open to the public, but registration is advised. Questions for the panelists can be submitted during the registration process.

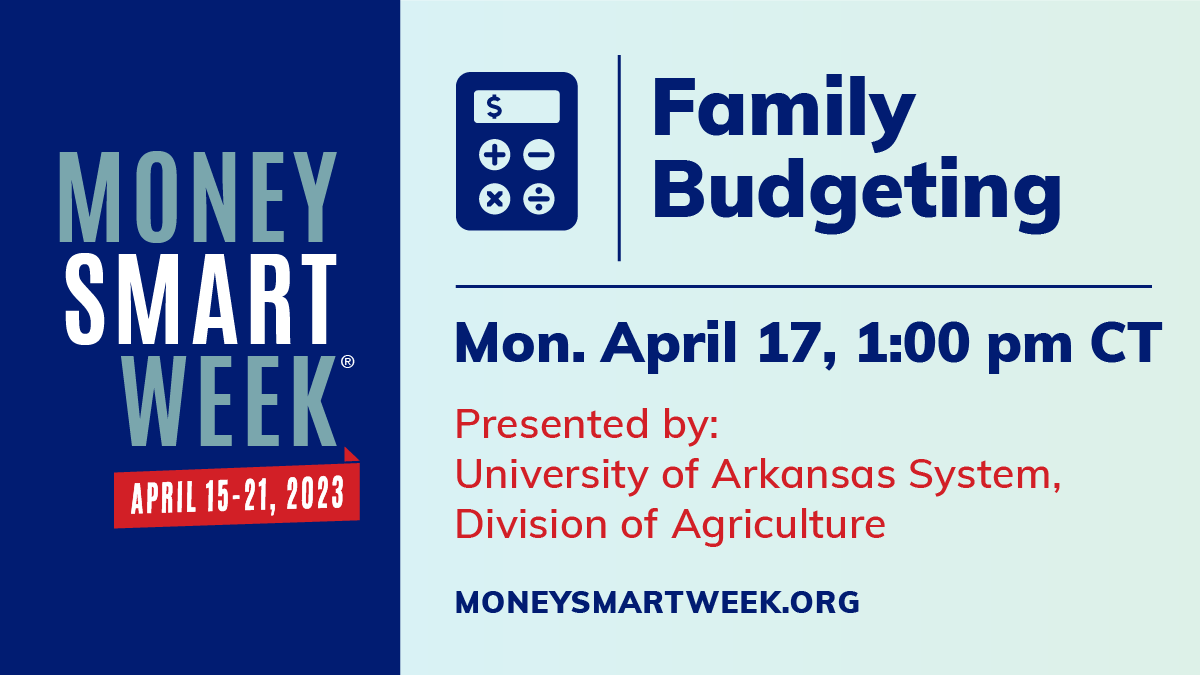

Family BudgetingMonday, April 17 | 1:00 PM

On Monday, April 17, 2023 from 1:00 p.m. – 1:20 p.m. CT Money Smart Week will host “Family Budgeting.” This free, virtual event is part of Money Smart Week, a week-long campaign that aims to help people better manage their personal finances through the coordinated efforts of experts and educators across the country. Budgeting is not just a matter of making a spending plan and cutting expenses. It’s important to set goals for where you want your money to take you. Motivation is important for adjusting behavior to see real results. Attend this session to:

Leave the session with access to information and resources that make it easier to manage your family’s budget, courtesy of the University of Arkansas System, Division of Agriculture. This event is free and open to the public, but registration is advised. Submit your questions during the registration process. |

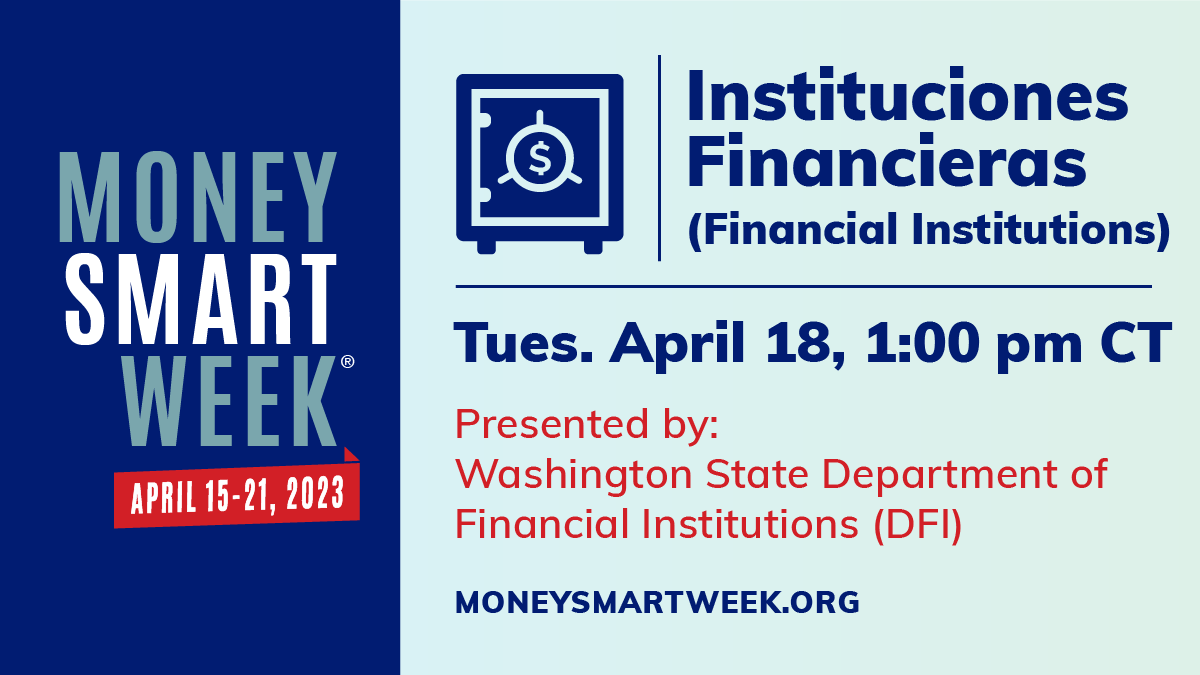

Instituciones Financieras (Financial Institutions)Tuesday, April 18 | 1:00 PM

On Tuesday, April 18, 2023 from 1:00 p.m. – 1:20 p.m. CT Money Smart Week will host “Instituciones Financieras.” This virtual event, conducted entirely in Spanish, is part of Money Smart Week, a week-long initiative that aims to help people better manage their personal finances through the coordinated efforts of experts and educators across the country. Banks, credit unions, money transmitters, check cashers, brokers, and other providers of financial services and products can play an important role in establishing financial wellbeing if they are understood and used properly. Vanessa Arita Reyes will highlight why it’s important to seek information and have conversations about financial systems in the communities we live in. Vanessa will share stories about her own top reasons to learn about financial institutions, including:

Banking can feel foreign even in your native language. The Washington State Department of Financial Institutions (DFI) makes these lessons more accessible to Spanish speakers with a presentation that focuses on how to have conversations about money and finances and how to analyze information to make the best decisions for your situation. This event is free and open to the public, but registration is advised. Submit your questions during the registration process. Live captioning in English will be available throughout the event. |

Debt ReliefWednesday, April 19 | 1:00 PM

On Wednesday, April 19, 2023 from 1:00 p.m. – 1:20 p.m. CT Money Smart Week will host “Debt Relief.” This virtual event is part of Money Smart Week, a week-long campaign that aims to help people better manage their personal finances through the coordinated efforts of experts and educators across the country. Financial products can be complex and confusing. Fear of sinking further into debt can leave consumers paralyzed. Worse still, hastily made decisions fueled by stress and urgency can lead to disaster. Regain control by attending this session in which the National Foundation for Credit Counseling will:

Leave the session with an understanding of the steps involved for proper debt management and the pitfalls that could set you back. This event is free and open to the public, but registration is advised. Submit your questions during the registration process. |

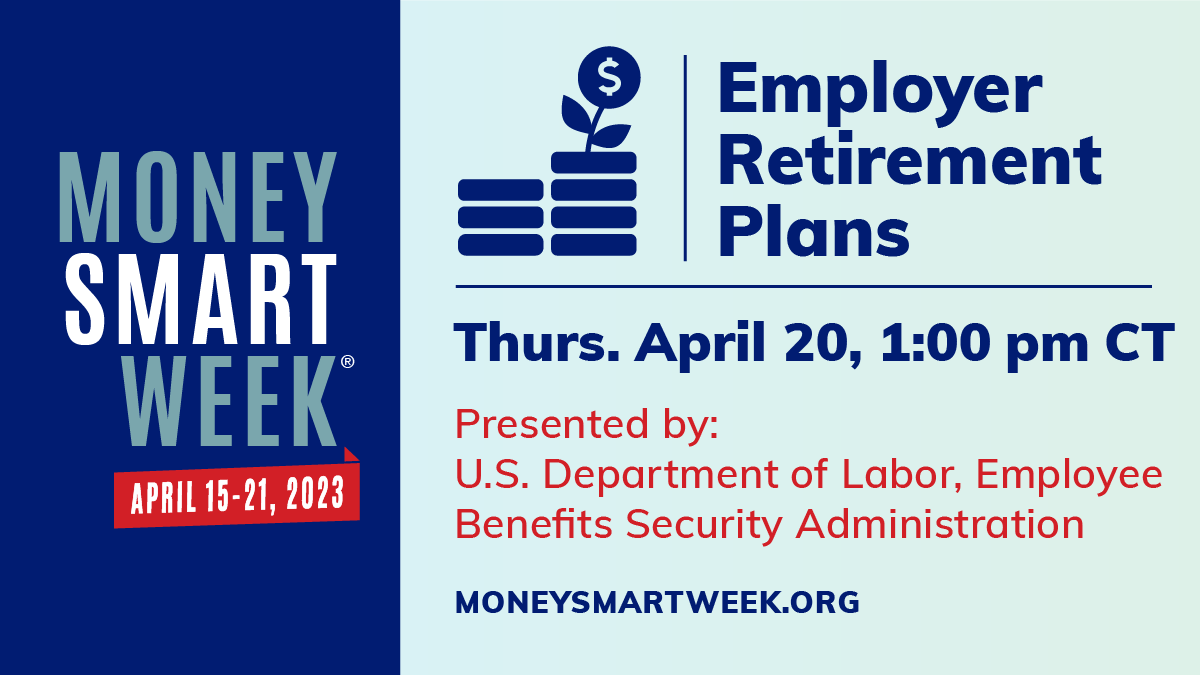

Employer Retirement PlansThursday, April 20 | 1:00 PM

On Thursday, April 20, 2023 from 1:00 p.m. – 1:20 p.m. CT Money Smart Week will host “Employer Retirement Plans.” This virtual event is part of Money Smart Week, a week-long initiative that aims to help people better manage their personal finances through the coordinated efforts of experts and educators across the country. Whether self-employed, underemployed, or working for an organization of any size, it’s important to know the paths available to secure your financial future. In this session the U.S. Department of Labor, Employee Benefits Security Administration will:

Leave this session with confidence in understanding the steps involved for securing your financial future and action items to take with your employer. This event is free and open to the public, but registration is advised. Submit your questions during the registration process. |